Stocks,

Shorts, and Naked Shorts Explained for the Intelligent Layperson

By Tim Patry

Link to PDF of the letter to SEC by Dr. Jim DeCosta and Associates

(1) Intro

This essay was written for the intelligent layperson who knows that the stock market exists but has never wanted to get into the complexities of the market. This essay will educate the reader on the fundamental principles of the stock market and then allow them to understand the grim circumstances in which we find ourselves.

At the end of this essay, you will know HOW the financial sector routinely steals from household investors (retail), you will know the solutions to the problem, and you will know how to protect yourself from the financial industry when politicians ignore those solutions.

(2) Meme

Stocks Revealed the Truth

The events surrounding the meme stocks have revealed the underlying structure of the Financial Sector by causing people who normally would not research the financial sector to try to figure out why the events surrounding the aborted short squeeze of so-called meme stocks (January 2021) happened and why the PRICE of these stocks continues to drop against all logic. Research has revealed that the price is being manipulated and how the price is being manipulated. This essay will focus on how the Financial Sector Professionals manipulate PRICE to take money from all non-professional participants in the market.

The underlying tools of manipulation, Shorts and Naked Shorts, existed before there was ever a “Meme Stock” and are indeed the reason why meme stocks exist. The goal of this essay is to make sure that no meme stocks ever arise again, because meme stocks were caused by corrupt business practices failing. The Financial Sector Professionals have generated billions in profits from corrupt business practices succeeding and those billions were taken from your families, 401Ks, and pensions.

There are government entities such as the Securities and Exchange Commission (SEC) that are supposed to protect American (and foreign) participants in the US stock exchange from predatory practices of Financial Sector Professionals. The problem is these entities are controlled by politicians. Politicians are controlled by money. The Financial Sector has more money than anyone.

Congressional Hearing to Oppose increasing stock market regulations.

(3) How

Money is Made in the Stock Market

Definition: Stock Market

A place where investors can buy and sell stock in publicly traded companies.

Definition: Stock

An ownership percentage in a company. If you own a stock in a company, you own some number of shares and that is supposed to represent the fact that you own part of a company.

Definition: Shares

Each company divides the total ownership of that company into some number of indivisible items. It is these items (shares) that are bought and sold on the stock market.

An investor makes money in the stock market in two primary ways:

1. Dividends: Many companies give a percentage of net profits back to the shareholders (who own shares). This is called dividends. If you have 10 shares of a company and the company gives $1 per share back to shareholders every year, you get $10 per year.

2. Buy Low Sell High: Many companies do not give back dividends to shareholders or give dividends so small they do not matter. Investors buy these shares thinking that the PRICE will go up later. If you buy at a low price and sell at a higher price, the difference is your income. This is called a LONG Investment because the investor is investing in long term gains.

Definition: PRICE

Price is the amount of money required to gain possession of a thing.

(4) PRICE

as a Consequence of Supply and Demand

According to micro-economics the price of a thing is determined by SUPPLY and DEMAND.

Definition: Supply

Market supply of a product is the number of units of that product available to be bought. Higher supply means lower price because people who will buy the product at a higher price already have it so others who are willing to pay less for the product have an opportunity to buy it. For example, if you have 100 eggs for a household of four you are unlikely to buy more eggs even at a great discount because you have enough.

For another example, if Tesla makes 100 limited edition Musky Husky Electric Pogo-Sticks then the supply is 100. Normally the company determines the price using their own mathematical models. However, let’s say that this product was sold at auction due to its limited supply. If 101 people want a Musky Husky but only 100 units exist, then that last person is going to go without. The price the 101st person is NOT willing to pay is the price of the 100th Musky Husky.

NOTE: Even if many of the Musky Huskies were sold for much higher, the price is defined by how much a current buyer would have to pay for the product. This will be relevant later.

Definition: Demand

Market Demand is the magnitude of desire potential customers have for the product. Higher demand increases the price because consumers are willing to pay more for the product.

In a stable industry supply and demand are fairly constant and the price does not change much. The influence of supply and demand on price is most evident when supply or demand changes because a change in either changes the price.

(5) Change

in Demand

Increase

If potential customers find out that the benefits of a product are greater than previously known, the demand will go up and so will the price. One common abuse of this aspect of supply and demand is the “Pump and Dump” where a Price Manipulator (PM) will purchase a large number of shares of some stock and then tell everyone who will listen that the stock is great. The price of the stock increases and PM sells their shares for a profit. This is sometimes considered illegal.

Decrease

If potential customers find out that the value of a product is less than expected, they will not be willing to spend as much for that product and the price will go down. This also happens if a replacement product comes along. When the DVD started being produced at similar prices to the VHS, the price of VHS went down because consumers preferred the convenience and quality of DVD.

One common abuse of this is Financial Sector Professionals purchasing negative articles about certain stocks causing Fear, Uncertainty, and Doubt (FUD) on the parts of people who own the stock and an unwillingness to buy on the part of potential customers. This allows the Financial Sector Professional to purchase the stock below actual value and later profit when the perceived value increases to appropriate levels.

(6) Change

in Supply

Increase

If there is only one manufacturer of a product, that producer can create a limited supply of that product and set the price high. If another manufacturer figures out how to make a product that serves the same function, they can flood the market and people who really want the product but who previously could not afford it will be able to obtain units from the copy-cat manufacturer which creates competition. For example, when Android smart phones hit the market the price of smart phones decreased. An iPhone would cost far more if alternatives did not exist.

Short Sales are the way Financial Sector Professionals legally abuse increasing supply to manipulate share prices.

Decrease

If the total number of units of a product available to be sold decreases, then the price will increase even if demand does not increase because only people willing to pay the higher price would get to purchase the product. For example, if the manufacturer of one component of all iPhones, had an accident at the plant and were only able to produce half the usual number of components resulting a decrease of the total number of iPhones sold in a given month, the price of the iPhone might increase. It would increase the price in secondary markets like craigslist and eBay.

Stock price manipulation through decreasing supply can be abused when Financial Sector Professionals start purchasing massive numbers of shares of a stock causing a rise in the price due to scarcity of the shares. This tactic is only available to institutions with millions (or billions or trillions) in assets under management. The increasing price is accompanied by purchased articles pointing out the increasing price trend increasing demand. The Financial Sector Professionals can then sell at higher price. Prevalence of Naked short selling in recent times has decreased the viability of this sort of abuse but naked short selling is a far greater abuse as will be described in detail shortly.

This resembles a “Pump and Dump” except it is legal because any penalties amount to a small fraction of the profits meaning the company has to pay a fee to use this tactic. Additionally, some of the profits are paid to politicians. Any activity where penalty is less than the generated income is legal because the penalty just amounts to a Cost Upholding Normalized Theft.

NOTE: Supply and Demand manipulation is price manipulation. Price manipulation is crucial to the Financial Industry because the industry makes money primarily through the Buy Low Sell High model. Massive corporations would have you believe that they do better research and hire smarter people than the average investor. However, how does a hedge fund that produces nothing generate billions in profits? Maybe they do have better research and hire people who are smarter than the rest of us; but maybe they cheat.

The problem is that they have the tools to manipulate prices and they have purchased the politicians needed to make the laws to give them the freedom to manipulate the price without consequences.

The most egregious example of legal price manipulation is the SHORT SALE.

(7) The Normal Short

In the movie “The Big Short”, smart people who saw the obvious flaws in the system were shown as heroes who profited from their foresight. I have nothing to say against the movie.

The shorts described in this essay are not like those shorts.

Remember the two ways of making money on the stock market described earlier? Well there are many more. Those dividends and buy-low-sell-high are the least vile ways to profit from the stock market and the ways most accessible to household investors like you, your family, and your friends.

Definition: Short Sale

A Short Sale is the sale of a security where the seller sells a share they do not own through a broker and ACCEPT OBLIGATION buy back later and return to the broker.

(8) The Mechanism of a Short

An investor BORROWS a share and sells that BORROWED hare on the open market. They later BUY a share and give it back to the person they BORROWED the share from.

Note: The BORROWER generally sells the share immediately through the broker as part of the process rather than taking actual possession of the borrowed share.

The mechanism for PROFIT on a short investment is: Borrow/Sell High – Buy Back Low. It is the inverse of the Buy Low Sell High model which is called a “Long”.

If someone is “long” on a stock it means they bought the stock and will benefit if the price goes up. Someone “short” on a stock has borrowed shares, sold them, and must buy back the shares hoping the price goes down. This is a bet against the company share price.

The Short Seller benefits if the price goes down in the time between BORROW/SALE and REPURCHASE. For example, if a business experiences a catastrophe such as an explosion at their main plant or legislation passed by the government that harms the business, the first people who find out can borrow shares of the company and immediately sell them. Once the public finds out and the demand drops the short seller can buy back the shares at a discount. For example, if a business has 1000 shares with a price of $10 each and congress signs a bill making that company’s product cost more, the politician who voted that bill into law can quickly (on their phone while they are voting) borrow 100 shares and sell them for $10 each pocketing $1000. If the price of each share drops to $5 the politician can buy 100 shares and give them back pocketing the $5. This is legal because politicians have no incentive to set laws to limit their income (or fund enforcement of any such laws).

It gets darker.

(9) The BROKER BETRAYAL

For a Short to work it requires the following components in the following order:

Lender: This is the person / entity that charges the Short Seller a fee to borrow a share that they own.

Short Seller: Pays a fee, takes possession of a share, then sells the share at market price to an UNSUSPECTING BUYER.

UNSUSPECTING BUYER: Normal participant in the stock market buys the share at market price adding it to their investment portfolio. This buyer is no different from any other buyer and their share is just as valid as any other share because shares are all the same.

NOTE: The Unsuspecting Buyer is not hurt in this transaction except insofar as every household investor is hurt by the practice. The problem is that the UNSUSPECTING BUYER is part of an UNSUSPECTING MARKET.

As shown above, short selling is preceded by short borrowing. The short seller must find someone who owns shares and is willing to loan them out so that a short seller can bet against them.

The person lending the shares expects to get the shares back along with a fee. The person lending the shares thinks that the value of the shares will increase or else they would sell so they do not incur losses.

Either that, or the one lending the shares and receiving the fee (BROKER) is not the one taking the risk (SHAREHOLDER who paid the broker for the shares).

Additionally, the act of lending shares artificially increases the supply of shares in the market decreasing the price. Why would investors who are betting that the share price will go up help other people bet against themselves? The Short Seller actively reduces the share price of their shareholder’s stock by increasing the supply.

Would shareholders bet against themselves for the fee?

Maybe, but it’s unlikely for household investors who don’t use complex mathematical models to weigh risks and expected gains from taking fees for lending while betting on a share price going up while helping a short seller bet against the investor whole using the investors shares to reduce the value of those shares.

The math is too complex for a normal investor weighing calculated benefit against calculated risk. For brokers, the risk is carried by the investor. Brokers gain profit by exposing customers to risk.

It turns out that when you buy shares in a company through a broker the broker owns the shares not you. The broker owes you something. They are not supposed to just take your money and give you nothing. However, the broker can lend your shares along with the shares of thousands of other investors to short sellers who then bet against you.

The broker owns the shares though they took your money to buy those shares. The broker lends the shares and pockets the fee while the price of your shares goes down due to artificial supply of the share. Your broker can profit by harming you and if you lose money, the broker does not lose money. The price of your company goes down and you gain none of the value but almost all the risk.

There is risk to the broker in a few cases which is why a broker will sometimes offer to pay you to allow them to lend your shares. This passes some of the risk to you because if the short seller borrows the shares and fails to deliver them back to you, then you signed off on the deal and your broker does not have to put the shares back into your portfolio.

Conclusion: If you own your shares through a broker, your broker may be profiting from your holdings by taking a fee for letting others bet against you. This was one of many Financial Sector betrayals uncovered by the Meme stock movement.

Luckily, the meme stock movement found a solution: Direct Registered Shares (DRS). Shareholders have the option of registering shares directly with the transfer agent for the company bypassing the broker and preventing their shares from being lent out for short sale to harm their investment.

(10) The Benefits of Shorts

If you run a hedge fund with billions under management, shorts seem like the best way to make money because, if you have enough money, the principles of supply and demand make short positions a self-fulfilling prophecy.

Imagine you run a hedge fund with $10 billion to play with.

You find a company that has 100 shares each representing 1% of the company.

You pay the brokers holding the shares for the investors some small percentage of the value of the stock and borrow 20 shares.

The total value of the company is $100 Million so each share is worth $1 million (a gross simplification but bear with me.)

You now have the obligation to buy 20 shares at some future date and give them back to the broker but you believe they will be cheaper in the future.

You sell 10 shares for $10 million. You sell the other 10 shares for 9 million.

Why did the price go down to half a million per share? The answer is that every investor willing to pay $1 million per share got the shares they wanted.

NOTE: 110 shares each work $1million to the buyers were sold. That is 110% of the company.

The last 10 shares were sold to people who were only willing to pay $900 thousand per 1% of the company. These people would never have had the chance to buy shares of the company if only 100% of the company was sold but once 120% of the company was sold, the price dropped far enough for them to buy.

From the perspective of investors who do not know about shorts, it looks like the total value of the company just dropped from $100 Million (100 x $1 Million) to $90 Million (100 x $.9 Million). They do not know that 120% of the company is sold. A downward trend happens as investors see they have lost money and try to get out of the investment by selling (demand drops).

Your hedge fund buys back the shares at $.8 Million making a tidy profit of $3 Million.

Investors saw the price start to drop and sold their shares before the price could drop more. Investors did not know that the value never changed but the supply of shares was manipulated.

THE PRICE WAS A LIE!

Conclusion: Short selling is a tool that hedge funds can use, aided and abetted by brokers, to manipulate share prices. If you want to purchase shares in a company you have to go through a broker who may plan to profit by letting hedge funds bet against you while manipulating the price against you. If you are holding shares in a company you can never know if the existing price is the value of a stock when 100% of the company is sold or the price when 120% of the company is sold.

The retail investor is at a disadvantage because they do not know what they are buying.

(11) The Risk of Short Selling

Short sellers bet that the price will go down and the very act of short selling increases the supply of that share reducing the share price creating a self-fulfilling prophecy.

But what if the price goes up anyway.

If the price goes up the short seller gets hurt. They have to increase the money set aside to buy back the shares (margin) and they have to buy back the shares at the higher value.

What if you buy 20 shares and sell them for $1 Million each but the price goes up to $2 Million? You have to pay $40 Million to buy the shares needed to close the short and bring the total percentage of the business sold back down to 100%.

What if the price goes up to $100 Million per share? You pay $2 Billion.

The risks are high in theory, though most of the time the price manipulation works especially if you buy articles in the MSM pointing out the dropping price for those investors not paying great attention.

Still, Financial Sector Professionals routinely use shorts to generate income.

Theoretically, shorts have their place. If you make a prediction that, based on some real factor that matters, the value of a company will go down why not be allowed to make the bet, see what happens, and profit from the investment/risk?

If household investors could profit from the lending of their own shares, if their brokers were not betraying them for profit, if the share price was not a lie and if the brokers of household investors were not facilitating those lies against their own clients, then maybe it would be fine.

However, if massive hedge funds need to lie to household investors via collusion with the brokers of those household investors in order to make a profit, it starts to look like an ugly, parasitic, evil industry. If you are trying to maintain your wealth by investing in the stock market, Short Sales are the monster under your bed.

It gets worse.

(12) Naked Short Selling

Shorts, when used to manipulate price and trick household investors into acting against their own best interests due to false information, are ugly malignant things.

However, when compared to Naked Shorts they seem downright honest; like little gremlins out to get your socks.

In the case of a normal short, a broker lends a share for a fee to a borrower who sells it and then buys and returns the share later.

There is moral hazard involved because the broker betrays their client, but at least the borrower has to find a lender.

What if the Short Seller did not have to find a lender? What if they could just create shares out of nothing except unenforced enforced rules?

This scenario is the case in America’s financial industry. Certain entities called Market Makers can simply sell shares that do not exist. This plus the fact that they have billions in assets under management allows them to completely control the stock price of any stock they want because they choose the price at which they sell their fake (synthetic) stocks. If a market maker wants to create a downward trend line in the price of a stock and then publish articles about the falling stock PRICE to sow fear into the investor, they can just do it using an algorithm on a computer.

When it comes to stock manipulation and false stock prices, naked shorts are the primary tool.

(13) Evidence of Abuse

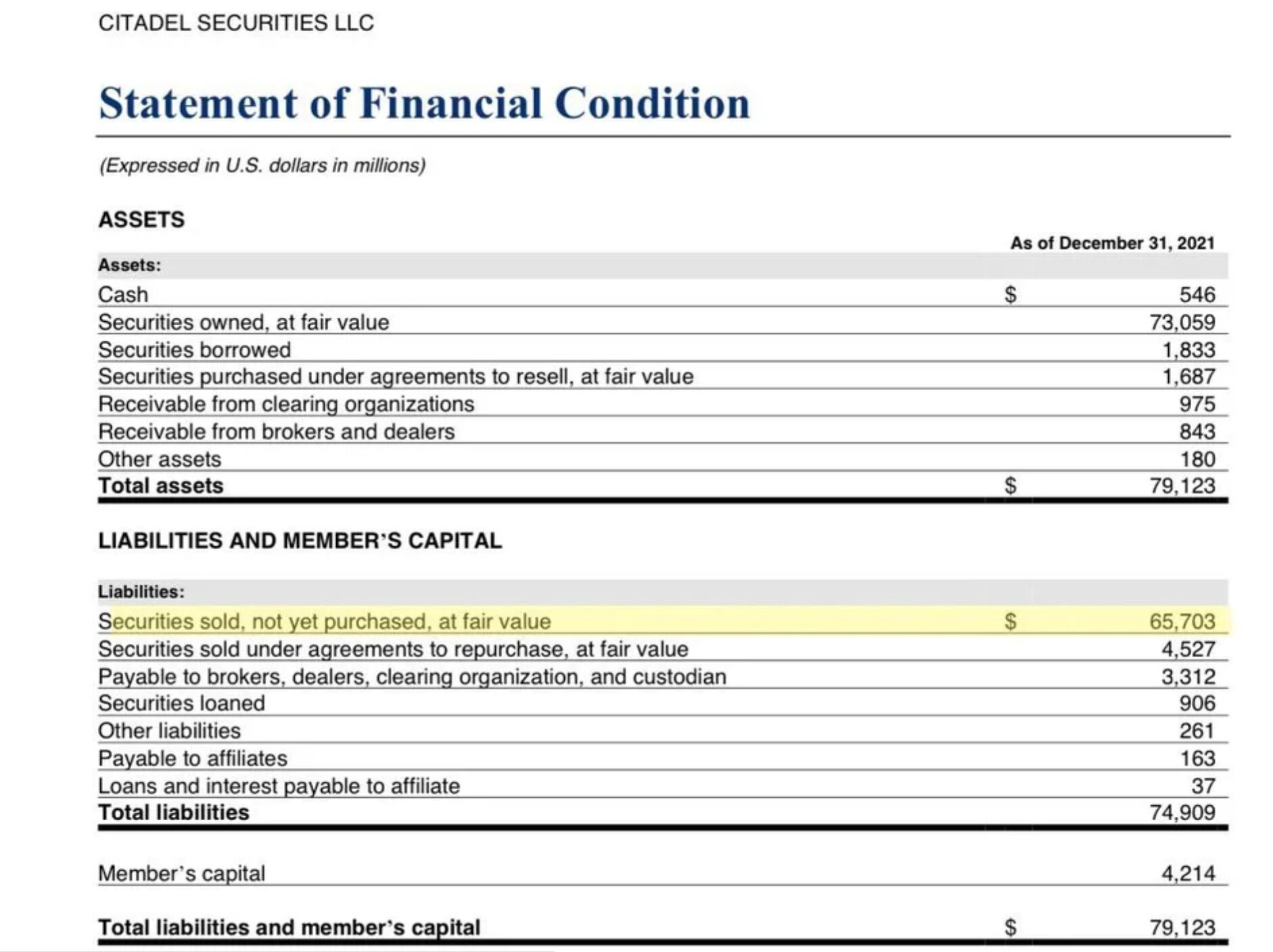

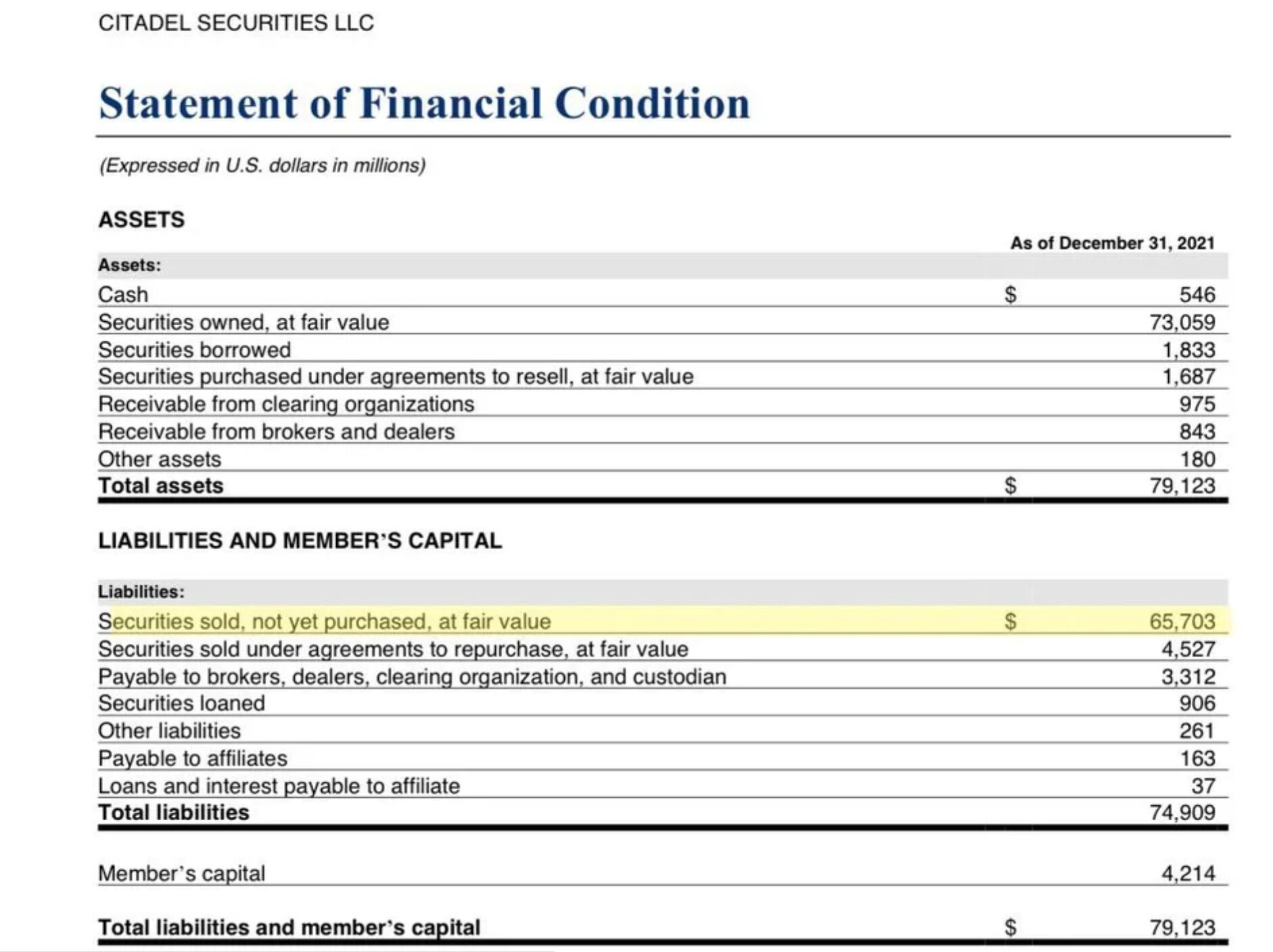

As of Citadel Securities own Statement of Financial Disclosure dated December 31,2021 the market maker admitted to having $65 BILLION in securities sold not yet purchased. (See below.)

In other words, the Market Maker (MM) had sold some number of shares and the fair market value of those shares at the time of the report was $65 Billion. The problem with this is that as soon as the company starts to repurchase shares the price will go up because supply will drop. They artificially decreased the price by selling the fake shares so once they start buying them back the price will go up.

In reality, this and other MMs owe far more than the many billions they admit. This is money they gained by selling percentages of companies when they had no right of possession for those percentages of companies.

The entire Meme stock thing started when household investors noticed that 140% of Gamestop had been sold. Now in reality 140% of a thing cannot exist so at some point those who sold shares of Gamestop that they did not own would have to buy 40% of the shares of Gamestop to bring the total existing percentage of the company to 100%, which is the most it can be in reality.

(14) The First Proof of Manipulation: They Turned Off the Buy Button

Once the egregious case of false shares was discovered the price went from $5 per share to a lot more up to the point where the Financial Sector Professionals, in an act of great unity, blatantly manipulated the share price.

They turned off the buy button. Robinhood gets the most press for this but so many other brokers joined in on the act. They made it so no one could buy Gamestop shares but anyone could sell them.

Back to supply and demand. By turning off the buy button, brokers like Robinhood created a FALSE LACK OF DEMAND and the share price tanked. This was pure price manipulation and it hurt those who rightly believed that short sellers would be forced to buy at outrageous prices. If the brokers had any shred of shame they would have halted trading and turned off both buttons. By only turning off BUY but not SELL they shamelessly protected the short sellers proving that household investors are not their true customers. Household investors are the product brokers they serve up to the market makers and hedge funds manipulating prices and misleading investors with false information.

Gamestop investors have been working to understand the Financial System that has made itself the enemy of every participant in the stock market ever since.

It gets worse.

(15) The VULTURE GAMBIT (Cellar Boxing)

According to a letter from Dr. Jim DeCosta and Associates, Consultants to Victim Corporations, entities with the ability to sell naked shorts routinely abuse this ability to literally destroy promising companies for profit. This method is known as Cellar Boxing.

Here’s simplified description of the practice.

In a letter to the Securities and Exchange Commission regarding the proposed Regulation SHO Dr. DeCosta explained in detail the problem. I will summarize briefly in this essay but I highly recommend the 34 page letter describing the problem in detail.

Naked short sellers can sell shares of a company without borrowing the share first. What is the limit? How many shares can a naked short seller sell? I am not personally sure. Hopefully not more than 100% of a company but logic is already gone so who knows?

What if multiple short sellers each sell shares worth 50% of a company? Theoretically, the company could be sold many times over.

There is risk involved with short selling and getting caught so it does not make any sense to sell a viable company several times over, but how about a non-viable company.

Say there is a company that is not going to survive because its business model does not work, its debts greatly surpass its assets, or its only product is about to become completely obsolete or illegal. Short sellers know that the value will go to zero. However, as long as the share price is not zero they can sell fake shares as much as they like. As they increase the supply of shares they run out of buyers.

(16) The Win / Win Slope

If naked short sellers continually sell fake shares and the company cannot survive, then the share price will drop to zero and the stock will be delisted from the stock market. Once that happens the naked short seller does not have a way to get the stocks needed to return the stocks to the brokers. Since the shares held by brokers for the investors no longer have any value, the short sellers keep all the money, the brokers lose nothing because the shares were either purchased by them or never purchased, and investors lose everything.

The win / win slope period is the time that doomed shares are being sold and the price is going down. If someone buys, then great! Market Makers get money. The price slopes down until no one buys. At that point the price drops to zero, the stock gets cancelled from the exchange and the market maker never has to pay anything back. For the naked short seller, it is a win / win because they either get money or freedom from any obligation to pay the money.

NOTE: In this case cooperation between Market Makers helps get the stock to the $0 PRICE and delisted. Until the price is $0, and the stock delisted there is risk for the market makers. Thus cooperation between entities that are supposed to be competing sometimes happens. Some have noticed that many different Market Makers and Short sellers were affected by the survival of Gamestop including Melvin Capital and Citadel Securities. The reason cooperation between competitors works in this case is the fact that there is no MARKET.

In Capitalism different companies COMPETE to provide goods and services to customers.

In the case of VULTURE GAMBITs, the Financial Sector Professionals are simply taking money away from the public and have no customers. Each share sold is one closer to getting the stock delisted and escaping any consequences for the betrayal of their implied purpose in the market which is to facilitate honest trades between honest investors. Thus, group activity is incentivized to reduce risk.

Have you ever heard the rule: Don’t poop where you eat? Well, the American Financial Sector has been making billions in profits every year by breaking that rule and now the market is unfit for anyone.

(17) The Situation

Selling naked shorts is rhetorically framed as a win for investors because market makers ensure liquidity meaning they make it easy for investors to get shares in a company even when no one is selling shares in that company. The fact that every naked short sold reduces the value of those shares is left unsaid by proponents of synthetic shares (naked shorts.)

NOTE: The term “synthetic shares” is a softer version of the term naked shorts which is inherently negative (naked) but any time a share is sold that must be bought back later that is a short. Thus, the act of selling a synthetic share is the act of making a short investment against a company because if the price goes down the market maker wins and if the price goes up the market maker loses and obviously market makers know this.

Anyone who sells shorted shares (borrowed or naked) is hoping that the one buying from them loses money because they expect that the PRICE of the sold share will go down. The act of selling short shares reduces the PRICE of the share without changing its VALUE.

The seller is obligated to buy back shares and return them to the broker removing them from the market, meaning price rises as supply is reduced.

One way to win through shorts is to foresee that the value of the shares is incorrectly high (the thesis of the movie The Big Short) which is the full justification for the existence of shorts as a respectable form of investment.

The other way to win is to convince investors that the PRICE of the share is actually equal to the VALUE of the share which is a LIE because PRICE = VALUE only when no more than 100% of the company exists. As long as shorts exist, the supply of the company corresponding to those shares is greater than 100%.

The scarcity of a product increases the price because customers cannot get the product without paying more than the next person. Shorts damage scarcity by lying about the percentage of a company sold but there is a theoretical limit on the number of shares that can be lent.

Naked shorts destroy scarcity because the number of shares that can be faked is limited only by the integrity of the market maker and the strength of the regulator. According to the research done by Dr. Jim DeCosta and Associates and members of the meme stock community, there is little to no evidence that market makers have integrity or that regulators have any strength or incentive to regulate.

(18) The CRIME

According to upcounsel.com, for a contract to be legally binding there must be value, called “consideration” for both parties involved.

Definition (upcounsel.com): “Consideration in contracts refers to the benefit each party receives in exchange for what it gives up in the contract. It is a vital element that must be present in a contract in order to make it legally binding on the parties. A contract, whether oral or in writing, becomes invalid if there is no consideration involved.”

In order to form a valid contract, consideration must meet the following conditions:

- It must be something worth bargaining for.

- It must benefit all the parties to the contract.

- It must be something of value.

Disproportionate Consideration

Consideration can be as big or small as the parties mutually agree to exchange between themselves. For example, when you go to buy a dress, it's between you and the seller to agree upon the price. When a valid consideration is present, courts rarely interfere to decide whether the deal is unfair or disproportionate. However, if a party is tricked into an unfair deal by hiding some important information or otherwise acting in bad faith, then it can affect the legal validity of the contract.

Naked short sellers (Market Makers who create and sell “synthetic shares”) who profit from the decaying corpses of doomed corporations not yet delisted from the stock exchange actively seek to violate the Essential Elements of Consideration after the fact.

At the time a synthetic share of DOOMED INC (a corporation going out of business) gets sold, the share has some theoretical value which is why the buyer buys the share for a PRICE. If the value of the percentage of the company represented by one share of the company is ZERO at the time the share was sold, maybe that is the fault of the buyer participating in the system because the BROKER can claim they had no knowledge or control over the value of the share or the price of the share.

If the Market Maker is creating fake shares of DOOMED INC with no intention of EVER repurchasing the shares to return to the broker, then any losses incurred by the buyer are the consequences of malicious practices because the Market Maker violated the principle of consideration. The market maker sold shares it knew would have an eventual PRICE of ZERO because it was actively working to bring the PRICE to ZERO via the Win / Win Slope mentioned previously.

Additionally, any broker selling shares to investors where more than 100% of the company has been sold through that broker must know that, mathematically, they are violating their own Principle of Consideration by taking money in exchanged for worthless digital assets fictionally created by enemies of their customers (the investors) actively engaging in acts to render worthless the shares sold through the brokers to their customers.

If Market Makers and Brokers are INTENTIONALLY selling goods to customers, where the PRICE IS A LIE (>100% of the company sold) and the sellers are INTENTIONALLY reducing the price of the goods to ZERO, then it would seem any funds paid by investors for these goods, once rendered worthless, should legally be forfeited back to the investor due to the retroactive nonbinding nature of the contract.

Furthermore, the act of selling fake, worthless goods to unwitting (due to lies not negligence) customers should be illegal. Many acts that have taken place regarding events surrounding the Meme-stocks are theoretically illegal and would be illegal in fact if they were ever enforced in fact.

Indeed, there is a saying in the Meme-stock community: “No cell, no sell.” In other words, until the thieves are put in prison there will be no mercy for the short sellers.

The most well-known actor on the side of the Naked Short Sellers is Ken Griffin, CEO of Citadel Securities. Many suspect he lied under oath to lawmakers in congress and there are even entire websites (kengriffinlies.com) dedicated to revealing those lies and the consequences that should have happened if enforcement agencies had the power and/or integrity needed to enforce the law.

(19) The Burden of INTENTION

At this point, some might be asking how INTENTION can be proved because lack of intention seems to exonerate, to some degree, any market maker or broker involved with naked short transactions.

Dr. Jim DeCosta and Associates brilliantly observed that the path through the decision tree of a naked short seller reveals that intent by demonstrating the series of decisions that result in a Market Maker never buying shares they committed to buy and thereby never closing the short position, never officially generating profits from those short sales, and some believe never paying taxes on those funds obtained by the sale of synthetic shares.)

Let us follow the decision tree for DOOMED INC (ticker symbol DOOM), a corporation who’s only product is worthless and who’s tangible and intangible assets are all fully encumbered:

A market maker sells 1,000,000 synthetic shares of DOOM for $5 per share. It now has $5 million in Short Sale Funds (SSF) and the contractual obligation to purchase 1 million shares from the stock exchange to return to the brokers who bought shares on behalf of investors.

The price drops to $4 per share. Does the market maker buy 1 million shares(for $4 Million), return the shares to the brokers, and pocket the $1 million in profits?

No, the market maker makes the DECISION: *not* [REPURCHASE SHARES SOLD NOT YET PURCHASED]. This is evidence of intent.

The Market Maker instead sells 1 million more shares at $4 per share. It now has $9 million in Short Sale Funds (SSF) and the contractual obligation to purchase 2 million shares from the stock exchange to return to the brokers who bought shares on behalf of investors.

The price drops to $3 per share. Does the market maker buy 2 million shares (for $6 Million), return the shares to the brokers, and pocket the $3 million in profits?

No, the market maker makes the DECISION: *not* [REPURCHASE SHARES SOLD NOT YET PURCHASED]. This is evidence of intent.

The Market Maker instead sells 1 million more shares at $3 per share. It now has $12 million in Short Sale Funds (SSF) and the contractual obligation to purchase 3 million shares from the stock exchange to return to the brokers who bought shares on behalf of investors.

The price drops to $2 per share. Does the market maker buy 3 million shares (for $6 Million), return the shares to the brokers, and pocket the $6 million in profits?

No, the market maker makes the DECISION: *not* [REPURCHASE SHARES SOLD NOT YET PURCHASED]. This is evidence of intent.

The Market Maker instead sells 1 million more shares at $2 per share. It now has $14 million in Short Sale Funds (SSF) and the contractual obligation to purchase 4 million shares from the stock exchange to return to the brokers who bought shares on behalf of investors.

The price drops to $1 per share. Does the market maker buy 4 million shares (for $4 Million), return them to the brokers, and pocket the $10 million in profits?

No, the market maker makes the DECISION: *not* [REPURCHASE SHARES SOLD NOT YET PURCHASED]. This is evidence of intent.

The Market Maker instead sells 1 million more shares at $1 per share. It now has $15 million in Short Sale Funds (SSF) and the contractual obligation to purchase 5 million shares from the stock exchange to return to the brokers who bought shares on behalf of investors.

The price drops to $0.50 per share, then $0.25, then $0.05. Does the short seller ever repurchase all the shares sold as per their contractual obligation?

If they did repurchase all those millions of shares for pennies on the dollar they would make millions of dollars in profit and, after paying income tax on those profits, could deliver a dividend to stockholders or increase the value of the fund or distribute the massive winnings taken from those who trust their brokers. This would be the unethical act of a vulture selling worthless products to investors who have been lied to about the price. This would be the high road in this situation.

Instead, per Dr. Jim DeCosta and Associates, there is evidence showing that naked short sellers wait until the stock has been delisted from the stock exchange and NEVER BUY BACK THE SHARES THAT THEY COMMITTED TO BUY.

If a market maker sells fake shares for a total of over $20 million and refuses to buy back those shares when it would cost less than $1 million resulting in a gain of over $19 million, this is evidence of intent never to repurchase the shares.

Notice again the Shares (C) Sold (R) not (I) yet (M) Purchased (E) on the financial statement of Citadel Securities:

“Securities sold, not yet purchased, at fair value” is given in terms of “at fair value” which is another way of saying PRICE. This line of the financial statement essentially states that the total PRICE of all “Securities sold, not yet purchased, at fair value”, at the time of calculation, was 65 Billion dollars. THIS IS A VAST UNDER-REPRESENTATION of the real events for two reasons.

Remember, as long as percentage of a company sold is greater than 100% the price is a lie because supply is artificially inflated over what is possible. This means that framing securities sold not yet purchased in terms of price is a lie.

Shorts equal FAKE increase in supply of existing percentage of the company because more than 100% of a company is sold on the stock exchange. This means that the LOWER PRICE OF THE SHARES IS FAKE.

Whenever a short seller CLOSES its short position, it buys back the shares of the company it BORROWED and returns those shares to the broker causing THOSE FAKE SHARES to no longer exist. This process of buying back shares reduces supply and INCREASES THE PRICE.

In other words, if Citadel tries to CLOSE the short position on all the shares sold not yet purchased, it has an obligation to buy back millions of shares REDUCING THE SUPPLY BY THAT NUMBER OF SHARES. This would result in an increase in PRICE as supply decreases.

If the liability represented by “Securities sold, not yet purchased, at fair value” was framed as the cost to CLOSE, it would theoretically be far greater than the $65 billion reported because CLOSING a short position removes fake shares from the SUPPLY increasing PRICE.

(Disclaimer: This follows if the reported $65 billion represents stock exchange price at time of reporting.)

The second reason $65 Billion is a vast underrepresentation of events is the fact that the stock price of any company removed from the stock exchange is ZERO and is therefore utterly unrepresented by this line item. How many dollars of capital have been consumed by Citadel (and others) for no consideration in exchange? This is not revealed.

THE INVESTORS WHO USE THE US FINANCIAL SYSTEM HAVE THE RIGHT TO KNOW THE EXACT NUMBER OF SHARES THAT HAVE BEEN SOLD AND NOT YET PURCHASED.

THE US TREASURY HAS THE RIGHT TO SELL DELISTED SHARES SOLD NOT YET PURCHASED BACK TO MARKET MAKERS FOR $0.001 (MINIMUM) DOLLARS PER SHARE SO ALL POSITIONS IN DELISTED STOCKS CAN BE CLOSED, PROFITS TALLIED, AND TAXES PAID ON PROFITS GAINED FROM SELLING NAKED SHORTS THAT WOULD NEVER BE REPURCHASED.

These are minimum rights that we should have regarding the VULTURE GAMBIT: The sale of synthetic shares of doomed corporations never repurchased. This is especially true if there was never an intent to repurchase.

(20) Killing Innovation

CELLAR BOXING has been so profitable for Market Makers they have gotten impatient and started killing vulnerable startups to generate corpses.

Dr. Jim DeCosta and Associates make the important observation that the world might have lost out on thousands of brilliant technological innovations that were killed by market makers and their synthetic shares.

NOTE: The letter by Dr. Jim DeCosta and Associates provided more insight into these matters. It is 34 pages long but worth the read. This essay is an attempt to deliver a simplified big picture perspective but there is more great information out there.

Here is an example to illustrate how market makers can kill innovation for profit.

IMMORTAL INC has a promising technological innovation they believe can deliver immortality. The company gets some initial funding from investment capital corporations and interested third parties and starts to work.

Their BUSINESS MODEL is to use the initial funding to prove the concept.

Once a prototype exists the company will then sell 80% of the company (as SHARES) on the stock exchange in order to generate the funds needed to perfect the product and scale up production in order to sell the product on the open market. The company will be sold in increments of 10% over time and the value of the company will only increase in value as the product gets closer to launch. If the concept can be proven the company should be worth $10 Billion Dollars to start. If the company value is divided into 10 million shares, then the value of each share should be $1000 and the value should only increase over time.

This business model is the weakness of the company because it fails to factor in the corruption of the financial system. Even if every mathematical assumption is true regarding the company and the product, the business model relies on selling shares at fair market value and as previously established, the PRICE IS A LIE if shorts exist.

The company sells 1 million shares (10% of the company) for $1000 each generating the $1 billion it needs to fund the next phase of development.

Short sellers borrow 5 million shares from brokers and sell them on the open market, increasing the supply and lowering the share price to $900 per share. (PRICE = $900 but VALUE = $1000 per share.) Investors who do not know that the price is a lie see that the price is going down, worry that the reported value was inflated, and some sell. This reflects a decrease in demand which reduces the PRICE to $800 per share.

Market makers sell 1 million fake shares further increasing supply, decreasing price, and decreasing demand due to falling PRICE which eventually drops to $500 per share.

The company needs more funding. It tries to sell another 10% of the company but, according to the PRICE ON THE STOCK EXCHANGE 7 million shares (70% of the company) have been sold and the share price reflects a lower total value for the company because THE PRICE IS A LIE.

The company which should now be worth $100 Billion (due to further developments in the technology) and have a share price of $10,000 has a share price of $500. The company has a working prototype and, if left unmolested, would deliver immortality to humanity through its product. However, the product is expensive to develop, and, at a false share PRICE, the company cannot generate the billions of dollars required to take the product to market.

The company starts to fail because it is undercapitalized (not enough money to operate).

Market makers notice (because they hoped for this outcome and have been circling like vultures) and start to sell more synthetic shares.

NOTE: There is massive risk when selling shorts (described next) so naked short sellers will wait until the death of a company is all but guaranteed before attempting the Win / Win Cycle of selling naked shorts until the company is delisted.

Market makers keep selling naked shorts until the business fails and is delisted.

Success! The short sellers successfully profited from a DOOMED company, but it was only doomed because the share price was manipulated and predicted funding which should have resulted in a profitable company was taken via the sale of fake shares and the ability to generate funding sabotaged by the PRICE manipulation of the same.

Theory VS Fact

In theory, short sellers can use the above process (disclaimer: maybe not this exact scenario but certainly this set of market factors) to make massive profits with minimal cost of goods sold (fake shares).

Please read the letter by Dr. Jim DeCosta and Associates to learn how often it happens in fact.

(21) The Risk to Short Sellers: Kill or be Killed

The use of synthetic shares (Naked Shorts) to take wealth away from public investors may seem like the perfect method for a Market Maker to get rich. Selling something in exchange for nothing seems like an ideal business model. However, this method comes with risks and those risks are absolute.

What happens if a market maker sells a large number of synthetic shares, and the general public finds out?

Death is what happens. Financial death.

Of course, this requires integrity on the part of the market maker to admit defeat and integrity on the part of regulators to enforce the law and integrity on the part of law makers to write just laws not full of loopholes and room for delay tactics.

(22) KILL

Financial Sector Professionals can kill companies by taking away investment capital causing them to be doomed and vulnerable to CELLAR BOXING.

(23) OR BE KILLED

But if the DOOMED company somehow survives the attempted CELLAR BOXING, the short seller has the OBLIGATION to buy shares that they cannot afford.

Example:

SAVED INC is an international company that has physical (brick and mortar) stores all over America and some in other countries. Due to a global pandemic people stop coming to physical stores for a while so the company starts failing.

The company has been divided into 100,000,000 (100 million) shares and each share has a PRICE of $5.

Short sellers sell 50% of the company: 50 million synthetic and borrowed shares.

Short sellers gain $250 million dollars (50 Mil shares x $5 per share.)

A group of household investors (regular folk) do research and figure out that a significant percentage of the company is sold short. They share that information with the public.

A large net worth individual leads a group of INSIDERS who purchase 40% of the company (40 million shares) for $200 million dollars.

Definition: INSIDERS

People who both own shares and run the company. When insiders purchase shares those purchases are publicly disclosed (announced to the world). The validity of their shares cannot be questioned because they announce who they purchase from, and any questions of validity would be asked by the seller and thus the validity of the purchase becomes the burden of the seller.

INSTITUTIONAL INVESTORS purchase 30% of the company (30 million shares) for $150 million dollars.

Definition: INSTITUTIONAL INVESTORS

Organizations that publicly announce their investments to the world. The validity of their shares cannot be questioned.

30 million shares remain in the FLOAT.

Definition: FLOAT

Shares owned by entities not required to publicly disclose ownership.

The group of investors figure out that short sellers will have to buy back massive numbers of shares at whatever PRICE is offered because they have an obligation to buy back what they sold after borrowing or FAKING (synthetic). They start buying shares.

The team of insiders starts to turn the company around and change the long-term financial fundamentals of the company.

SHORT SELLERS REALIZE THAT THE COMPANY, SAVED INC, WILL NOT FAIL AND THE PRICE WILL NOT GO DOWN.

Members of the public realized that short sellers must buy at any cost so the PRICE starts to rise because any price will have to be paid.

A SHORT SQUEEZE begins.

Definition: SHORT SQUEEZE

The drastic rise in the price of a stock when short sellers have to buy to fulfil their obligations, but the supply is so low that CLOSING SHORTS (reducing supply) costs more and more money to get owners of the share to sell.

The short sellers with the most integrity start buying up shares in order to close their short position and escape the Kill or be Killed scenario. This leaves the short sellers in a terrible financial situation because the bet against the share price failed. However, any “honest” short seller has CLOSED THEIR SHORT POSITION and is free of the obligation to buy at any cost to return the sold shares.

The short sellers who CLOSED their short position are FREE. They were hurt but not killed.

The price rises to $100 per share.

Those who did CLOSE have the obligation to buy at $100 per share to start with and to keep buying shares as the price increases.

Those who did not close their short position may never have the opportunity again because the price has increased to the point where any decrease in supply will lead to extreme increases in PRICE due to awareness of the fact that the short positions have to be closed.

Due to naked shorts, there do not exist sufficient shares in reality to close every short position because more than 100% of the company was sold. Even if a company had INFINITE dollars if sufficient shares do not exist it would not be able to buy enough shares to complete its obligation. The obligation is infinitely deep. This is called the INFINITY POOL. This concept has been around since at least 2021 when the Meme-stock movement began.

NOTE: If you google “Infinity Pool” you will find no mention of the stock market on the first page. Instead, the top result is:

INFINITY POOL (FILM)

Infinity Pool is a 2023 science fiction horror film written and directed by Brandon Cronenberg, and starring Alexander Skarsgård, Mia Goth and Cleopatra ...

Some suspect that the film was created to obfuscate the concept of INFINITY POOL as it relates to short sales from search engine optimization.

(24) ZOMBIE COMPANIES

A short sale is a gamble with infinite risk. If you buy a share your maximum risk is the loss of 100% of the PRICE of your share. If you short, you must buy back at any cost. Theoretically, that cost could be infinite because there is no maximum upper boundary on the risk.

Theoretically, those who sell shorts are supposed to keep money on hand to pay if their gamble does not pay off. These are called MARGIN REQUIREMENTS. In practice, short sellers may meet margin requirements for the current price on the stock exchange, but they do not keep enough margin to pay the amount that would be required to CLOSE a short position in a SHORT SQUEEZE.

An investment company that has access to less funds than it would need to CLOSE its short position is essentially dead.

If an investment company sells every asset it has in order to CLOSE a short position, it dies because an investment company has to have some amount of assets under management. If that amount is ZERO, it has nothing to invest and no basis for existing.

Companies that have sold shares that cannot be repurchased are ZOMBIE COMPANIES because they are required to buy stocks, but they would have to sell every asset they have to buy those stocks (and they still might not have enough.)

A ZOMBIE COMPANY can continue to exist by never CLOSING their short position. A company can COVER a short position by borrowing new shares in order to return shares to brokers. This never reduces supply, never increases price, and never requires a company that has lost the KILL OR BE KILLED gamble to truly die.

In fact, ZOMBIE COMPANIES can continue to make KILL OR BE KILLED gambles and mathematically die multiple times as the continue to sell shares they do not own to investors who do not know that the entire Financial Sector might be run by ZOMBIE COMPANIES constantly selling fake shares and rendering the entire concept of a stock exchange a parasitic and predatory joke.

THE QUESTION OF TRUTH

If you buy a share of a company that represents 1% of that company, are there 99 other shares that exist just like it, or are there one million other shares out here just like it each representing 1% of the company?

In a fair and just system, you would have a way of knowing. In a fair and just system the total percentage of a company sold on the stock exchange would at least occasionally equal 100%

The only way to get there is to make dead companies die. This may be difficult because ZOMBIE COMPANIES have great incentive to make large campaign contributions to politicians willing to let them continue to steal from their constituents.

However, suppose we keep the shorts, keep the naked shorts, let all the theft and grift and predatory practices continue as market makers sell shares they promise to buy later.

When they fail, make them die!

(25) TIME TO DIE

In a fair and just system, a lot of things might be different including the existence of short positions and synthetic shares.

For now, forget all that and focus on the situation of a hypothetical ZOMBIE COMPANY.

BRAINZ PLZ is an investment firm that borrowed 1 million shares of SAVE INC and sold at the market price of $2 dollars per share when the share price was falling. The company rallied and the price is now $4 per share and more importantly, the company will survive and there is no evidence that the share price will fall that far again.

If synthetic shares were sold and market makers tried to create a Win / Win Slope it would not work because the company is holding enough cash to thwart attempts to destroy it through share price. There is no way to sell synthetic shares at this point without revealing that they are synthetic.

The only reason fake shares normally work is because no one knows they are fake.

NOTE: Some people believe that the DTCC should know what shares are fake and which ones are real.

If BRAINZ PLZ were to try to purchase 10 million shares the share price would climb to $10,000 or higher. BRAINZ PLZ could CLOSE the short position, but it would have to liquidate 90% of the assets under management which would result in investors leaving, which would effectively end the investment company.

BRAINZ PLZ has lost the bet.

BRAINZ PLZ is mathematically dead because it has the obligation to purchase shares for an amount of money that would destroy the company.

BRAINZ PLZ instead finds other companies with the same problem and sells share back and forth through the DARK POOL in order to COVER short positions and survive another day.

Definition: DARK POOL

A place to trade shares that does not affect the supply and demand calculations of the public stock exchanges.

In other words, dark pools are designed to keep truth of the true supply, demand, and price away from the household investors blindly putting their money into the hands of Financial Sector entities who, by use of dark pools, demonstrate their opposition to the idea of a stock market where household investors have a chance of succeeding.

NOTE: Bad information results in bad choices so every household investor should at least be aware they swim in water deeper than they can see and where the lifeguards are paid by the sharks.

Day by day BRAINZ PLZ keeps surviving. They make more KILL OR BE KILLED bets most of which are successful but one of which they lose.

They make a bet against OOPSADAISY INC but the company survives. BRAINZ PLZ is now obligated to buy 1 Million shares of OOPSADAISY INC to close its position, which would cost 80% of the company’s assets under management.

It now has an obligation to CLOSE two short positions:

SAVE INC: 90%

OOPSADAISY INC: 80%

Before the bet against OOPSADAISY INC, the company was doomed. After the bet, it is mathematically dead and has obligations it can never fulfil.

It could still fulfil one obligation but then it would have no assets and its complete financial ruin would reveal the moral hazard demonstrated by continuing to make KILL OR BE KILL bets when nearly all assets under management were owed to shareholders of another company.

Definition: Moral Hazard (Investopedia)

Moral hazard is the risk that a party has not entered into a contract in good faith or has provided misleading information about its assets, liabilities, or credit capacity. In addition, moral hazard also may mean a party has an incentive to take unusual risks in a desperate attempt to earn a profit before the contract settles.

If a DOOMED company makes a bet that would result in an obligation it cannot fulfil, that is moral hazard.

Once an investment business is doomed, it’s continued existence is a moral hazard because it has noting to lose and the only way it can ever recover is if the companies it bet against finally die.

If the business continues to exist, it will always have incentive to try to destroy the company that survived its initial murder attempt. The doomed company acting against its intended victim is doubly wrong because, at the moment it failed to kill its victim company, it incurred the obligation to liquidate sufficient assets to CLOSE its short position and the shareholders of that company effectively gained the moral right to those assets.

After failing to kill SAVED INC, BRAINZ PLZ has an obligation to liquidate 90% of its assets and pay those funds to shareholders of SAVED INC. and morally, those funds belong to those shareholders. BRAINZ PLZ has a fiduciary responsibility to safeguard and remit those funds to their rightful owners.

If the funds are not immediately remitted, BRAINZ PLZ will be incentivized to attempt to destroy the investment of the shareholders of SAVED INC even though it owes nearly all of its assets to those same shareholders.

In other words, if a company enters a KILL OR BE KILLED bet, if it loses it must be killed immediately or else its continued existence will result in MORAL HAZARD.

Additionally, once it fails a second time and has no hope of ever fulfilling its contractual obligations it becomes a living Ponzi scheme. An existence borne and sustained by moral hazard.

Every dollar spent by a ZOMBIE CORPORATION is a crime against the shareholders of the stock it failed to close because those are dollars owned by others.

Every dollar spent in effort to reduce the share price of shares it is obligated to buy is a double crime unless that dollar is spent within a reasonable amount of time, there is some hope that the money spent could effectively reduce the amount needed to CLOSE the short position, and as long as the funds spent does not reduce the assets under management to the point that the DOOMED company cannot fulfil its obligation to buy the shares it promised to by to close its position.

Any further bets made by the DOOMED corporation are moral hazard because they are bets made with the money of others.

In this case, moral hazard means THEFT.

(26) There Should Be CRIMINAL LIABILITY

If a company owes 170% of its net worth to the shareholders of two other companies and the CEO and board of directors decide to spend $1 million in fees in order to sell additional shorts, that is effectively a criminal conspiracy to spend $1 million dollars that someone else owns.

If a company owes 170% of its net worth to the shareholders of two other companies and the CEO and board of directors decide to pay ANYONE a bonus that is theft. If they pay any person a dollar when that person was party to a decision to engage in the risky bets that resulted in the obligation to pay 170% of corporate net worth, that is larceny.

If an investment company that owes 170% of its assets under management to the shareholders of two other companies and an investor is allowed to withdraw funds, that is theft because those funds were risked by the person who invested in the company and now belong to the shareholders of two other companies.

Conclusion

There are many conclusions to be made based on the contents of this essay and the egregious abuses allowed by the current legal structure of the Financial Sector of the United States of America. Causes of outrage abound.

For the purpose of this essay, I will only focus on two.

First: Short Sellers Owe Everything to the Shareholders of the Stock they Sell

Any entity that takes a short position (sells shares it is obligated to buy later) incurs an obligation to CLOSE its position in as SHORT a time as possible. A short position is a lie that manipulates the price of a share downward and this lie should exist for as little time as possible. Until every short position of a company or individual is closed, they have no right to spend their own money because all their assets have been wagered.

Laws must be enacted to this effect and then enforced with violators receiving sentences appropriate to the crime and any politician or official standing against this effort is an enemy of the American People IN FACT because their efforts knowingly bring harm to the American People.

Second: You (The Reader) are in Danger

NOTE: This is not financial advice insofar as I will not tell you where to invest your money.

Brokers exist to facilitate trades and to hold your portfolio. They stand to profit by betraying you by lending your shares to your enemies. If you must participate in the stock market you can Direct Register your shares to ensure that they are in your name rather than in the name of the broker so that they cannot be lent against your interests and without you benefitting.

Market makers have the power to freely manipulate the PRICE of any stock. They stand to profit by manipulating your emotions and influence your DEMAND by manipulating the PRICE of any stock you are interested in.

The PRICE is a LIE. Even if the value is much higher than the price, the price may never go up because THE PRICE IS A LIE. Invest with the knowledge that reality, common sense, and rational cause and effect influence PRICE only insofar as they are allowed to by Financial Sector Actors. You can beat the system but only if you understand what the system really is; a cesspool of corruption and entities structurally incentivized deceive you. You are protected by politicians paid by those entities and regulators staffed by those entities.

Unless you know you belong in that world, you do not belong in that world.

How to Protect Yourself

FINAL THOUGHT: In my humble opinion, the safest bets on the stock market are those companies that the Financial Sector Actors attempted to destroy already. Any company that survived an attempted murder seems at least safer than those who have not endured such a storm. Do your own research.

If you have money to invest and you are reading this essay, then you are probably a member of the dwindling middle class. The financial sector depends on your ignorant investment. Do your own research and protect yourself.

Many smart people have come up with many smart solutions to the problems outlined in this essay. These solutions would spell doom for Zombie Corporations and your politicians may have been paid to oppose these solutions. At the end of the day, you are responsible for your own financial decisions. Make those decisions carefully. Protect yourself.

If you buy shares consider Directly Registering Shares (DRS) in your own name so they cannot be lent out by brokers to hurt your investment for the gain of the broker. Protect yourself.